|

|

Dallas Fed Chairman Richard W. Fisher in Toronto discussed Fed stimulus and markets hooked on ’monetary cocaine’

7 June 2013

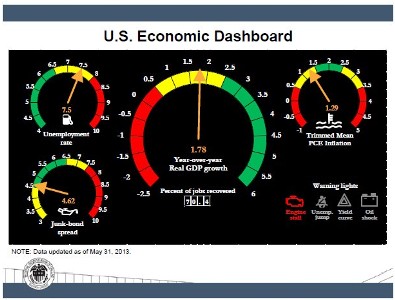

(CRC)—Following a formal conference presentation on the evening of June 4 in Toronto, Dallas Federal Reserve Chairman Richard Fisher had a Q&A period, with one journalist asking if he was preoccupied by rising bond yields. The Chairman answered that while the situation was being monitored, his belief was that policymakers and not markets should dictate policy: “We cannot live in fear that gee whiz, the market is going to be unhappy that we are not giving them more monetary cocaine,” reports Thomson Reuters’ Money News. While Chmn. Fisher did not reiterate his recent call for the Federal Reserve to cut back on its $85 billion a month QE3 stimulus, he said that: “…I argue that the Fed has no hope of moving the economy to full employment, despite having pulled out all the stops on the monetary front, unless our fiscal authorities get their act together. Those economic agents with the wherewithal to expand payrolls and put the American people back to work must have confidence that our fiscal authorities and regulation makers—the legislative and the executive—will reorganize the tax code, spending habits and the regulatory regime so that the cheap and abundant money we at the Fed have made available to invest in job-creating capital expansion in the United States is put to use. Until then, I argue that the Fed is, at best, pushing on a string and, at worst, building up kindling for speculation and, eventually, a massive shipboard fire of inflation.” While the outspoken Dallas Fed Chairman did not use the occasion of his evening speech before the C.D. Howe Institute Directors’ Dinner to launch one of his broadsides against the 1999 repeal of the Glass-Steagall law in the United States, he did criticize both the Congress and the Obama White House by stating that: “Until the Congress and the president provide a clear road map to restoring fiscal rectitude, economic growth will continue to be impeded by undue uncertainty about future tax rates, future government purchases, future retiree benefits and all manner of factors that prevent the U.S. from achieving its long-run potential. Meanwhile, the divisive nature and petty posturing of those who must determine the fiscal path of the nation are further undermining confidence, hindering the upward momentum needed for a full recovery and limiting the effectiveness of monetary policy.” In the course of his main evening conference presentation, Fisher argued that fiscal policy was “inhibiting the transmission of monetary policy into robust job creation” and introduced a humorous one minute YouTube video by saying: “As this is an after-dinner speech and a little levity is always helpful in making a point at this time of night, here is my favourite spoof on the historical behaviour of fiscal policy makers in Washington, D.C.”: He also used his ‘U.S. Economic Dashboard’ to illustrate how the economy is cruising along but could easily spin out of control. “…Now, on to the status of the U.S. economy and monetary policy—of special interest to you because we account for three-quarters of Canada’s goods exports and a substantial amount of Canadian direct and portfolio investment. “Here is a handy graphic we use at the Dallas Fed as a simple indicator of the current predicament of the U.S. economy:

“As shown, the most recent data for real gross domestic product (GDP) and inflation—as measured by the Trimmed Mean Personal Consumption Expenditures (PCE) Index, the Dallas Fed’s preferred indicator—have both increased less than 2 percent year over year after first-quarter GDP growth was revised to 2.4 percent and the 12-month run rate for Trimmed Mean PCE inflation came in at 1.3 percent at the end of April. “The dashboard indicates that the U.S. economy is cruising along at what appears to be near-stall speed—note the “Engine stall” red warning light. The unemployment rate gauge is not red because it declined to 7.5 percent in April. As indicated by the odometer box, we have traveled some distance in job creation, even though we have not seen the job creation we might have hoped for in a typical recovery: 70.4 percent of jobs lost in the recent recession have been recovered, up from about 50 percent only a year ago. “The warning light for the yield curve should be pink, if not yet red, for, if anything, it is robust to the point of possibly becoming problematic in giving rise to speculative impulses. Despite the most recent widening, junk-bond spreads are below 5 percent, as shown; nominal yields for even the lowest-grade bonds (CCC-rated credit that is one notch above default) have fallen to below 7 percent from double digits only a year ago. This is of interest because, according to Dealogic, we have had $187 billion of junk bonds issued in the U.S. so far this year, a record. Further, covenant-light lending is on a tear. And unless you’ve been living on another planet, you know we have experienced a roaring bull market for equities. Thus the “oil lamp,” shown in the lower left corner of the dashboard, depicts that the Fed has supplied plenty of lubrication for the engine of job creation. “Over the four years since the recession ended in June 2009, GDP growth has averaged just 2.1 percent, hewing to a narrow year-over-year range of 1.5 to 2.8 percent. It is noteworthy that the fraternity of U.S. professional economic forecasters has been consistently disappointed: Forecasts made at the beginning of 2010, 2011 and 2012 all over predicted growth. At the onset of this year, the median projection of professional forecasters called for 2.4 percent GDP growth for all of 2013, and that, too, has been challenged by first-quarter data that came in below expectations, raising fears of “déjà vu all over again.” Fisher also attacked the incompetence of most economic forecasters, by recounting the following story: ”…I ask that you treat any forecast from any source with what I like to call “Arrow’s Caveat.” “During World War II, future Nobel laureate Ken Arrow served as a weather officer in the Army Air Corps. He and his team were charged with producing month-ahead weather forecasts. Being a disciplined analyst, Arrow reviewed the record of his predictions and, sure enough, confirmed statistically that the corps’ forecasts were no more accurate than random rolls of dice. He asked to be relieved of this futile duty. Arrow’s recollection of the response from on high was priceless: “The commanding general is well aware that the forecasts are no good. However, he needs them for planning purposes.” Richard Fisher will be attending the upcoming International Economic Forum of the Americas conference in Montreal June 10-14 |